The European Securities and Markets Authority (ESMA), which oversees EU markets, recently released an updated version of its proposed guidelines for the use of sustainability and ESG terms in investment fund names. One of the new features is the addition of a new category called “transition,” which allows labels to be used to identify funds that include investments that aren’t currently considered green but are instead concentrated on transition strategies.

The European Securities and Markets Authority (ESMA), which oversees EU markets, recently released an updated version of its proposed guidelines for the use of sustainability and ESG terms in investment fund names. One of the new features is the addition of a new category called “transition,” which allows labels to be used to identify funds that include investments that aren’t currently considered green but are instead concentrated on transition strategies.

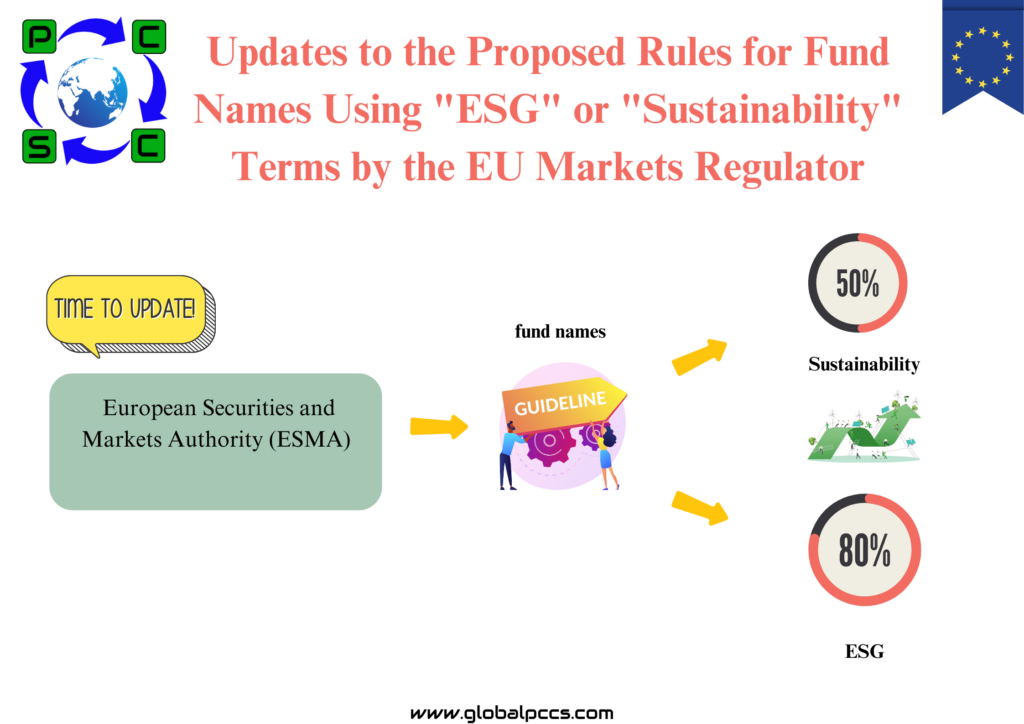

In order to protect investors from the risk of greenwashing, the regulatory body said that the guidelines, which were made available for public comment in November 2022, were designed to ensure that fund names that include terms like “ESG” or “sustainability” accurately reflect the investment policies and objectives of the funds.

A suggestion made during the first round of consultations was to establish a cutoff point for the minimum percentage of investments needed to back an ESG-related fund name. This cutoff point would be 80% for words related to ESG and 50% for terms related to sustainability, such as “sustainable.”

Investor organizations criticised the system’s inclusion of distinct criteria for words connected to sustainability and environmental sustainability, arguing that investors, who frequently do not discriminate between the two, would become confused by it. After public consultation, ESMA eliminated the 50% sustainability-related threshold and replaced it with new guidelines that called for an 80% minimum proportion of investments to meet the sustainability characteristics, the application of Paris-aligned benchmark (PAB) exclusions (such as companies that produce tobacco products or weapons of mass destruction, or that derive more than 10% of their revenue from the exploration, production, or refining of oil fuels), and investing “meaningfully” in sustainable investments that are in line with the SFDR definition.

The creation of a new category for transition-related words, which would maintain the 80% investment barrier but not the PAB exclusions relating to fossil fuels, is another noteworthy modification to the standards. The regulator also pointed out that the fossil fuel exclusions would place undue restrictions on funds having words like “social” or “governance” in their titles.

Authorised IMDS & CDX Training & Consulting partner for

Authorised IMDS & CDX Training & Consulting partner for