The European Chemicals Agency (ECHA) announced changes to administrative fines under the EU REACH Regulation on July 23, 2024, with effect from July 22. The goals of this modification are to make charge structures more equitable, boost transparency, and match fees to real operating expenses.

The European Chemicals Agency (ECHA) announced changes to administrative fines under the EU REACH Regulation on July 23, 2024, with effect from July 22. The goals of this modification are to make charge structures more equitable, boost transparency, and match fees to real operating expenses.

Revision of Fee Context:

ECHA levies fees in accordance with the REACH Regulation for particular services. For qualifying small businesses, it provides discounted fees to lessen their financial burden; nevertheless, businesses who fail to prove their eligibility will be subject to further fines.

Definitions of Fees:

- Service Charge: For services that fall under the purview of REACH.

- Administrative fine: Applied to businesses who cannot demonstrate their eligibility for a discount.

Decision Specifics:

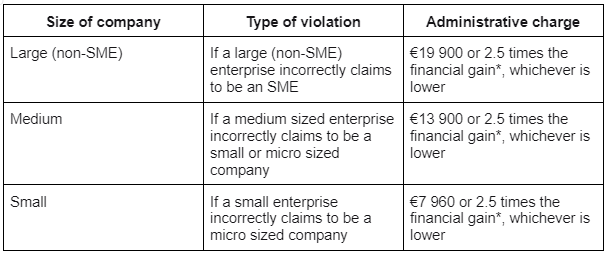

Original Penalty Standards: Reductions in fees are given to SMEs who correctly state their size upon registration. However, ECHA will impose a cost equivalent to the amount saved because of inaccurate information if an applicant is unable to verify their eligibility for a discount.

Revised Penalty Guidelines:

Organizations who neglect to confirm their eligibility for reductions risk further fines. Only the highest fee is assessed in joint applications, and the primary applicant is responsible for paying it. The fine is reduced if a corporation quickly verifies and corrects any misreported size.

Furthermore, pre-invoice verification has been added to the definition of “financial benefits,” broadening its application.

Administrative penalties remain unchanged from previous years. Details are provided below.

Note: Financial gain is defined as the difference between the total amount owing and the fees that are lowered as a result of inaccurate or incomplete information.

Policy for Service Fees

Before certain services are started, ECHA works with applicants to determine a maximum service price. The daily fee is fixed at €600 at this time.

Specific documentation is required for entities hoping to be classified as SMEs. These documents include the ownership structure as it was in the application year, financial audits from the two years prior, and an official headcount of workers. Before being submitted, these documents must be translated into English by translators who have been accredited by an established European organization. Additionally, companies that are categorized as joint enterprises (those that hold more than 50% of the shares in other companies) or partnership enterprises (those that hold 25–50% of the shares in other companies) must also combine the balance sheets and total number of employees of all associated enterprises.The criteria should be carefully considered by applicants, since failure to do so may result in large extra penalties in addition to the necessity to pay the difference in administrative costs.

Authorised IMDS & CDX Training & Consulting partner for

Authorised IMDS & CDX Training & Consulting partner for