To help financial institutions set aggressive short-term emission reduction objectives, the SBTi offers updated information and additional tools.

To help financial institutions set aggressive short-term emission reduction objectives, the SBTi offers updated information and additional tools.

Financial institutions (FIs) will be able to set ambitious near-term carbon reduction targets with the use of additional resources and modifications made available by the Science Based Targets initiative (SBTi). Aiming for 1.5°C, financing conditions for fossil fuels are among the modifications, along with general usability and clarity enhancements.

The Financial Institutions’ Near-Term Criteria Version 2.0 is the main resource that has been made available (FINT Criteria V2). Table 2 provides a more thorough breakdown of the modifications. In general, the revised standards seek to:

- Align criteria with the SBTi Corporate Net-Zero Standard; particularly, raise the minimum scope 1 and scope 2 mitigation objective from 1.5°C to far below 2°C.

- Improve usability, actionability, and clarity in relation to the current criteria.

- Reduce the number of coverage criteria.

- Outline requirements for the new Fossil Fuel Finance Targets method option, which enables financial institutions to report, suspend, transition, and eventually phase down their fossil fuel-related operations.

The FINT Criteria V2 will be implemented on November 30, 2024. Financial institutions (FIs) may opt to be evaluated using the Criteria and Recommendations for Financial Institutions Version 1.1 or the FINT Criteria V2 if they submit their objectives by this date. Within five years after the validation date (which can be found on the SBTi Target Dashboard), financial institutions (FIs) possessing targets that have undergone SBTi validation are required to revise them in accordance with the most recent criteria.

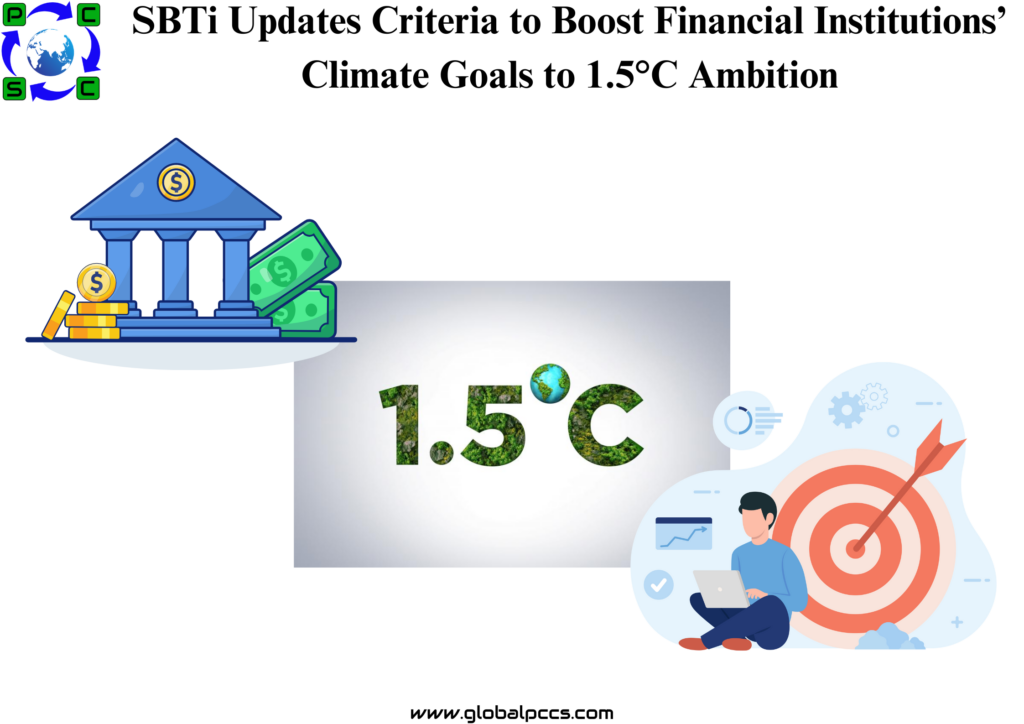

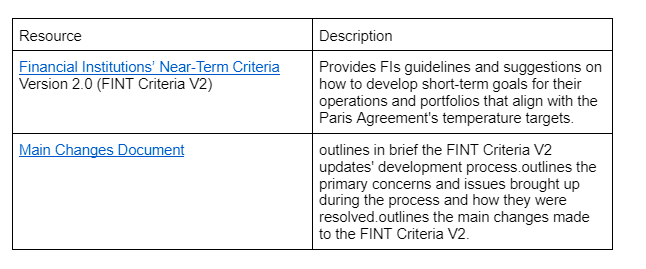

Table 1 lists each of the updated resources:

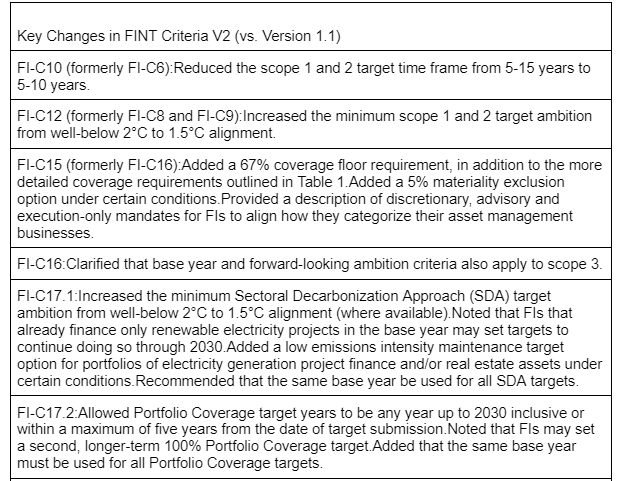

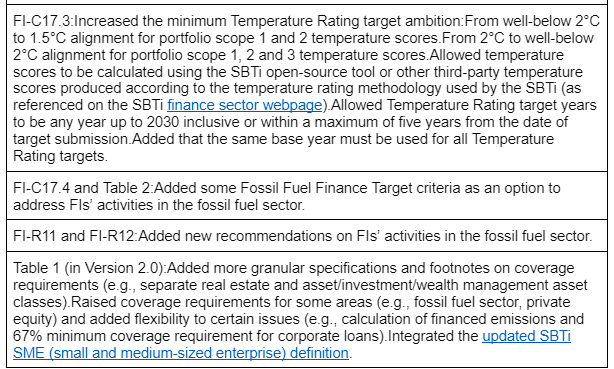

Table 2 below provides a summary of the key changes made in FINT Criteria V2 compared to Version 1.1:

The other papers have also been updated to reflect these changes. The Main Changes Document has a larger and more thorough list of revisions.

Additionally, the SBTi is creating a Financial Institutions Net-Zero Standard to help FIs create science-based objectives that are both short- and long-term in order to achieve net-zero. In the upcoming months, there should be updates on this effort.

Authorised IMDS & CDX Training & Consulting partner for

Authorised IMDS & CDX Training & Consulting partner for